Research Paper

“Customer’s Trends towards Public and Private Sector Banks”

*Mr. Aseem Mathur, Research Scholar, PAHER, Pacific University, Udaipur (Raj.)

**Dr. Jayant Sharma, Sr. Lecturer, Dept of Business Administration, Govt.

Meera Girls College, Udaipur (Raj.)

Introduction

India’s banking system is one of the largest in the world. An extensive banking network has been established during the last thirty years. Now ‘Anywhere Banking’ and ‘Anytime Banking’ has become a reality. Banking activities have increased tremendously with a clear change in philosophy and techniques especially in the field of lending, from wholesale to retail character. Now, customer is the key component of banking industry. Banking Industry can neither function without customers nor is just acquiring a certain number of customers sufficient for their business. It is a continuous process of transactions culminating in a long term banker-customer relationship. Recognizing the need and importance of customer services in banking, the researcher has attempted to study the attitude and preferences of customers towards public and private sector banks. A questionnaire survey from 100 respondents was conducted to study the banking habits and preferences of Indian customers and the responses received were analyzed to understand the attitude and preferences of customers in selecting a public or private sector bank. The implications of the study will be beneficial for the banking industry, as it will help them understand the customer preferences in availing the banking services and will help them improve their services to attract customers & satisfy their needs.

Banking Services in India

The banking industry in India has witnessed several regulatory changes during the last decade which have resulted in a heightened competition among the banks. Nationalized and old generation banks have started facing stiff competition from new private banks with international banking service standards. These new generation banks offer a wide range of services and deliver service quality. A new class of banks, “New Private Sector Banks (NPSBs)”, came into existence as a result of liberalisation of Indian economy, which is competing with both foreign and Indian banks for market share. The domination of Public Sector Banks has declined over the years with the entry and aggressive expansion of the Private Banks. NPSBs perceived future competition among banks would be essentially based on the state of the art technology and infrastructure, comparable to that of banks in developed countries.

Literature Review

The business literature is flooded with vast array of studies on customer’s banking preferences in various countries but such studies are limited in the Indian context. Even though, customer preferences vary from country to country based on culture, demography, affordability, IT penetration etc., a review of the customer banking preferences in other countries may throw some light on the subject of the study.

According to Kavita and Palanivelu (2012), banking institutions thrive more on keeping old customers happy rather than getting new customers, no bank possibly meet all the needs of its customers given to the diversity of their wants.

Banking Sector in India has undergone tremendous changes in its operations during the last decade. Owing to the highly competitive scenario; it is pertinent to note that banks need to differentiate themselves from each other. Sarangi and Srivastava (2012) measured the strength and impact of the organizational culture and communication on facilitating employee engagement in Indian Private Banks.

Devlin and Gerrard (2005) studied the relative importance of various criteria for selection of main and secondary banks by customers. Results showed that relatively rudimentary factors such as location, recommendation and relationships were most important criteria for choosing a main bank.

Almossawi (2001) studied the bank selection criteria by students of University of Bahrain. Findings revealed that the major criteria determining the bank selection by students were bank's reputation, availability of parking space, friendliness of the bank personnel and availability and location of ATMs. Study also found that the priorities of male and female students differed.

Huber et al. (1998) found that bank customers tend to be loyal provided they are satisfied with its services and they stick on to the same bank for five to seven years on an average and change over only when they move to a new home in an area outside their bank's network.

Mylonakis et al. (1998) concluded that the most important criteria for bank selection are convenience, bank reputation, quality of products & services, interest rates & fees, education & personnel contacts, facilities, branch environment, services and after service satisfaction. Their research on bank customers of Greece showed that criteria like location, convenience and quality of service (attention to the customer, personalized service, no queues) influence the bank selection and factors like Advertising did not seem to influence bank customers.

Nielson et al. (1998) conducted a survey of CEOs of business firms and banks to find out how well banking industry in Australia understands the need of their business clients. Significant differences were found for six factors, which business firms considered prior to establishing a banking relationship. Business firms were found to place far more importance on the banks willingness to accommodate their credit needs, efficiency of banking operations and the fact that banks have knowledge of their specific business. On the other hand, banks felt it was more important for them to offer competitive prices, full range of services and provide a personal banking relationship.

Edris and Almahmeed (1997) conducted a study at Kuwait and concluded that the true determinants of bank selection decision made by business customers are more likely to be a function of both perceived importance of bank attributes and the difference among banks in a given region with regard to each of these attributes.

Thwaites and Vere (1995) studied the student buying behaviour of banking services and concluded that students are not convinced about the concept of financial supermarket and were more inclined to shop around for the best offer. They were also found conducting business with more than one banking institution and were not particularly loyal.

Profitability of banks and growth of client base are interlinked. With intensifying competition in the market, it is very important for the banks to understand “How customers choose their banks?” Thereafter, the banks can take proper marketing efforts to increase client base. Improper identification of true determinants of consumers’ bank selection decision criteria may result in poor results for marketing efforts. Management’s failure to identify customers’ desire is also a kind of quality gap (Zeithmal et al., 1990).

Research Methodology

The research is based on the primary data collected by the researcher through a questionnaire survey. The first part of questionnaire contained questions about demographic information of the respondents, viz gender, educational qualification & monthly income. The second part of questionnaire was designed on the basis of factors selected from various empirical research works covered in the literature review and were finalized after several rounds of discussions with selected panel of bankers, bank customers and an academician. The questionnaire listed the important factors identified as the influencing factors on decision making and satisfaction levels of the clients. The factors were represented on Likert Scale of 1 to 5, 1 - representing “Very Important” while 5 representing “Not Important”. The weighted average scores of all responses were calculated and the scores on importance were ranked and tabulated.

The geographical region for the study was Udaipur City. The questionnaires were distributed to 100 clients/customers who came for investment purposes in branches of State Bank of India, Punjab National Bank, ICICI Bank and HDFC Bank. The sample of respondents was based on convenience sampling. The responses received are tabulated above. Out of the 100 questionnaires distributed, 79 filled-up questionnaires were received back. Of these, 4 were rejected for incomplete information. Thus, a total of 75 responses were analysed. 34 completely filled up questionnaires were received from public sector banks & 41 from private banks. Thus, response rate was better from private bank (82%) compared to public sector bank (68%).

Data Analysis and Discussion

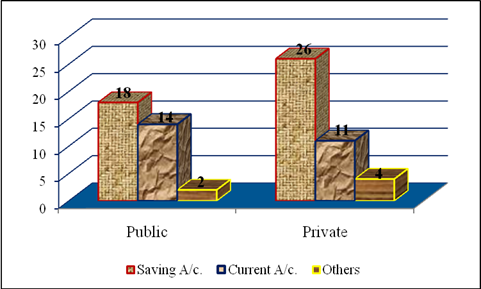

Table 1 shows the number of customers having account in bank and the type of account the customer holds in the bank.

Table 1: Type of Bank & Bank Accounts

|

|

Saving a/c |

Current a/c |

Others a/c |

Total |

|

Public |

18 |

14 |

2 |

34 |

|

Private |

26 |

11 |

4 |

41 |

|

Total |

44 |

25 |

6 |

75 |

45% of the respondents have account in public sector banks and 55% have accounts in private banks. Out of the 75 respondents, 59% have savings account, 33% have current account and 8% have other types of accounts (Cash Credit, Recurring Deposit, etc.).

Figure 1 graphically depicts the number of customers having savings, current & other accounts in public & private sector banks.

Fig. 1: Type of Bank and Bank Account

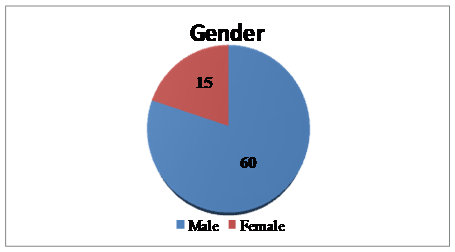

Table 2 & Figure 2 show the gender classification of the respondents.

Table 2: Gender Classification of Respondents

|

|

Male |

Female |

Total |

|

Public |

29 |

5 |

34 |

|

Private |

31 |

10 |

41 |

|

Total |

60 |

15 |

75 |

Fig 2: Gender Classification of Respondents

80% of the respondents in the sample were male while 20% were female. The gender classification shows that yet the male in India are mainly performing the banking & financial transactions in the family/business.

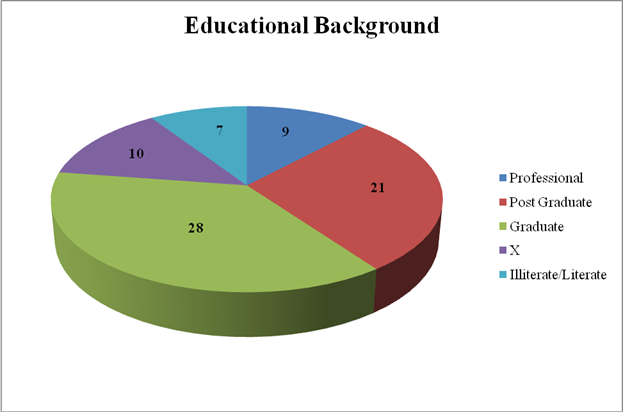

Table 3 & Figure 3 show the educational background of the respondents.

Table 3: Educational Background of Respondents

|

|

Professional |

Post Graduate |

Graduate |

X |

Illiterate/Literate |

|

Public |

3 |

7 |

12 |

6 |

6 |

|

Private |

6 |

14 |

16 |

4 |

1 |

|

Total |

9 |

21 |

28 |

10 |

7 |

Fig 3: Educational Background of Respondents

Out of 75 respondents, 12% were professionals, 28% were post graduates, 37% were graduates, 13 were X pass and remaining were illiterate or literate. The illiterate seemed to be more associated with the public sector banks and more educated & professionally qualified were more associated with private sector banks.

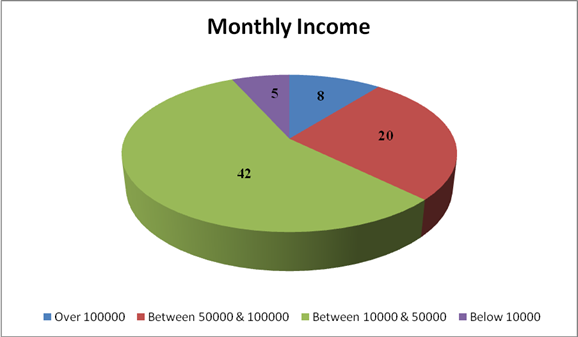

Table 4 & Figure 4 show the monthly income of the respondents. Out of 75 respondents, 8 reported monthly income over Rs. 100,000; 20 reported monthly income between Rs. 50000 & Rs. 100,000; 42 reported monthly income between Rs. 10,000 and Rs. 50,000 and remaining reported monthly income below Rs. 10,000.

Table 4: Monthly Income of Respondents

|

|

Over 100,000 |

Between 50,000 & 100,000 |

Between 10,000 & 50,000 |

Below 10,000 |

|

Public |

3 |

8 |

18 |

5 |

|

Private |

5 |

12 |

24 |

0 |

|

Total |

8 |

20 |

42 |

5 |

Fig 4: Monthly Income of Respondents

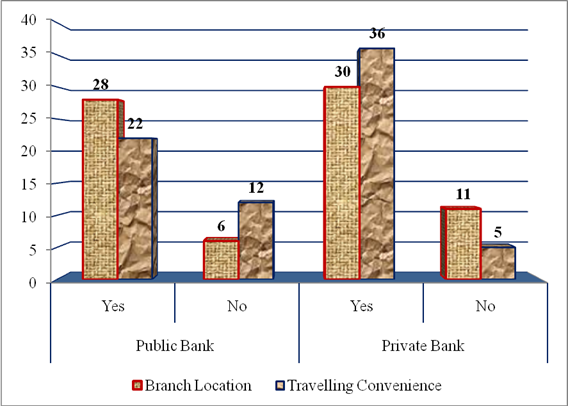

Table 5: Response to bank branch location & travelling convenience

|

Convenient Branch Location & Travelling Convenience |

||||||

|

|

Public |

Private |

||||

|

|

Yes |

No |

Total |

Yes |

No |

Total |

|

Branch Location |

28 (82.4) |

6 (17.6) |

34 (100) |

30 (73.2) |

11 (26.8) |

41 (100) |

|

Travelling Convenience |

22 (64.7) |

12 (35.3) |

34 (100) |

36 (87.8) |

5 (12.2) |

41(100) |

Table 5 & Figure 5 show the responses relating to the convenient location of bank branch. Most of the customers agreed that the branch location & travelling to branch was convenient for them. Figures in parenthesis represent the percentage of respondents.

Fig 5: Convenient Branch Location & Travelling Convenience

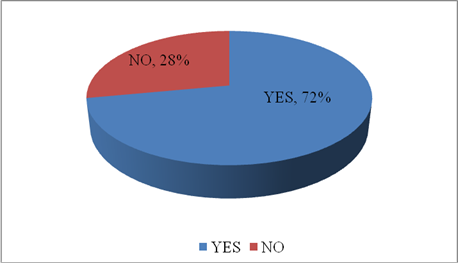

Figure 6 represents the customer responses to the availability & use of transaction tracing systems.

Fig 6: Customers using Transaction Tracing System

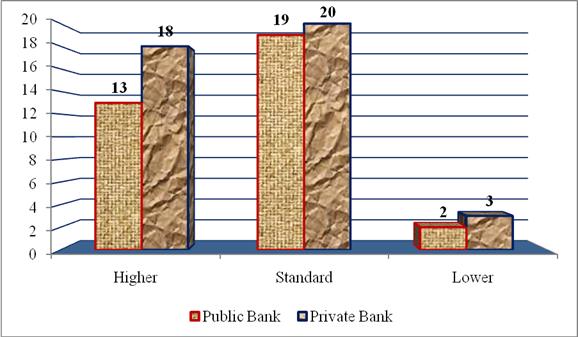

Figure 7 represents the opinion of customers about the charges/commission charged by bank for various transactions.

Fig 7: Bank Charges/Fees for various transactions

For the factors considered in choosing a bank, safety of funds was ranked as the most important factor by the respondents. The other important factors in their preference order were secured ATMs, ATMs availability, reputation, personal attention, pleasing manners, confidentiality, workplace vicinity, timely service and friendly staff willing to work.

Conclusions and Recommendations

The 10 most important factors influencing the selection of a bank by respondent are safety of funds, secured ATMs, ATMs availability, reputation of the bank, personal attention, pleasing manners of the staff, confidentiality, workplace vicinity, timely service and friendly staff willing to work. It is understandable that safety of the funds is ranked number one in making the bank selection decisions. The factor “reputation of the bank” also has the perception about “safety of funds” built in it.

It is found that security and availability of ATMs finds a top priority in customer bank selection. Hence banks’ have to give due importance in establishing a safe and wide ATM network of its own or entering into alliances with various banks. This also shows that customers are frequently using ATM for transactions in non-banking & wee hours of the day and thus they are concerned both about security & availability of ATMs.

Similarly, the soft skills of the counter staff members has a significant role to play in influencing bank selection decisions of the customers, which is evident from the fact that five out of top ten factors are found to be the factors linked with the performance of the staff members.

While rate of interest on deposits has a significant influence in bank selection decisions, clients are ready to pay reasonable service charges.

On the other hand, “Advertisements” was not ranked important by respondents, which lead to the conclusion that “advertisements” on standalone basis do not influence the selection of a bank by the customers.

On the basis of the above study, researcher want to recommend certain points are as following:

· Banks should take significant efforts in selecting, training and motivating the staff members to perform to the satisfaction of customers and also continuously monitor and take feedback about its employees.

· Banks do not need to spend much amount on the part of advertisements

· Banks should take only reasonable service charges.

· There should be more numbers of ATMs in the prime locations of the city as well as in the rural areas.

· Counter staff members should be trained properly for dealing with clients/customers and should be able to handle their queries and problems effectively

References

:

Aish EMA, Ennew CT, McKechnie SA, et

al., (2003), “A cross-cultural perspective on the role of branding in financial

services: The Small Business Market”. Journal of Marketing Management; Vol. 19,

Pp. 1021-1042.

Almossawi M. (2001), “Bank selection criteria employed by college students in Bahrain: An empirical analysis”. International Journal of Bank Marketing; Vol. 19, Pp. 115-125.

Biranchi Narayan Swar and Prasant Kumar Sahoo (2012), “Service Quality : Public, Private and Foreign Banks”, SCMS Journal of Indian Management, Vol. IX, No. 11, July-September, IISN 0973 – 3167, pp. 43 -51.

Colgate M & Hedge R. (2001), “An investigation into the switching process in retail banking services”. International Journal of Bank Marketing; Vol. 19, Pp. 201-212.

Devlin JF (2002), “Customer Knowledge and Choice criteria in retail banking”. Journal of Strategic Marketing; Vol. 10, Pp. 273-290.

Devlin J & Gerrard P. (2005), “A study of Customer Choice Criteria for multiple bank users”. Journal of Retailing and Customer Services; Vol. 12, Pp. 297-306.

Edris TA & Almahmeed MA (1997), “Services considered important to business customers and determinants of bank selection in Kuwait - A segmentation analysis”. International Journal of Bank Marketing; Vol. 15, Pp. 126.

Huber CP, Lane KR & Pofcher S. (1998), “Format renewal in banks - it's not easy”, McKinsey quarterly; Vol. 2, Pp. 148-154.

Kannabiran G & Narayan PC (2005), “Deploying Internet banking and e-commerce - Case study of a private sector bank in India”. Information Technology for Development, Vol. 11, Pp. 363-379.

Levesque T & McDougall GHG (1996), “Determinants of customer satisfaction in retail banking”. International Journal of Bank Marketing; Vol. 14, Pp. 12-20.

Mylonakis J, Malliaris PG, Siomkos GJ, et al., (1998), “Marketing-Driven factors influencing savers in the Hellenic bank market”. Journal of Applied Business Research, Vol. 14, Pp. 109-116.

Nielsen JF, Terry C, Trayler RM, et al., (1998), “Business banking in Australia: a comparison of expectations”. International Journal of Bank Marketing; Vol. 16, Pp. 253-263.

Phuong HT & Har KY (2000), “A study of bank selection decisions in Singapore using the analytical hierarchy process”. International Journal of Bank Marketing; Vol. 18, Pp. 170-180.

Thwaites D & Vere L (1995), “Bank selection criteria-a student perspective”. Journal of Marketing Management; Vol. 11, Pp. 133-149.

Zeithmal VA, Parasuraman A & Berry LL (1990), “Delivering quality service balancing customer perceptions and expectations in”. Free Press, New York.

Zineldin M (1996), “Bank Strategic Positioning and some determinants of bank selection”. International Journal of Bank Marketing; Vol. 14, Pp. 12-22.